Meta 101: Analysing and Interpreting Ad Performance Metrics

Ever feel like you’ve just been handed he keys to a spaceship, but the dashboard has a thousand blinking lights you don’t understand? That’s what looking at your Meta Ads data can feel like. It’s enough to make you want to throw your laptop out the window. (Don’t do that.)

You’ve launched your campaign, but now you’re faced with a sea of numbers. CTR, CPC, ROAS… and you’ve no idea if you’re flying to the moon, or crashing back to Earth.

In our Meta 101 series, we’ve already discussed the foundational pillars of a successful campaign:

- Setting your Objectives (your destination).

- Finding the right Audience (your crew)

- Planning your Budget (your fuel)/li>

Now that your foundation is set, it’s time to learn how to read the most important map of all: your ad performance metrics.

Your Ad Performance Metrics Cheat Sheet

Trying to analyze every single metric is a surefire way to get overwhelmed. The key is to focus on a few core numbers that directly tie back to your campaign objective. We’ll break these down by their place in the marketing funnel, providing you with a clear guide on what to look for and what it all means.

The Awareness Funnel (Visibility & Reach)

These metrics tell you how well your ad is performing at the very top of the funnel. Are they effective at getting your brand in front of the right audience?

- Reach vs Impressions: This is a foundational concept. Impressions are the number of times your ad was displayed. Reach refers to the number of unique individuals who saw your ad. If your ad has 1,000 impressions and a reach of 500, it means the average person saw your ad twice.

- Frequency: This metric tells you the average number of times a single person views your ad. A high frequency can be a telltale sign of ad fatigue, indicating that your audience is growing tired of seeing the same ad repeatedly.

Pro Tip: Your audience will get bored. As your frequency rises (typically around 2-3), your ad performance often starts to decline. When you see this happening, it’s a sign that you need to refresh your ad creative to keep your audience engaged.

The Consideration Funnel (Engagement & Interest)

Once people see your ad, are they interested enough to take action? These metrics answer that question.

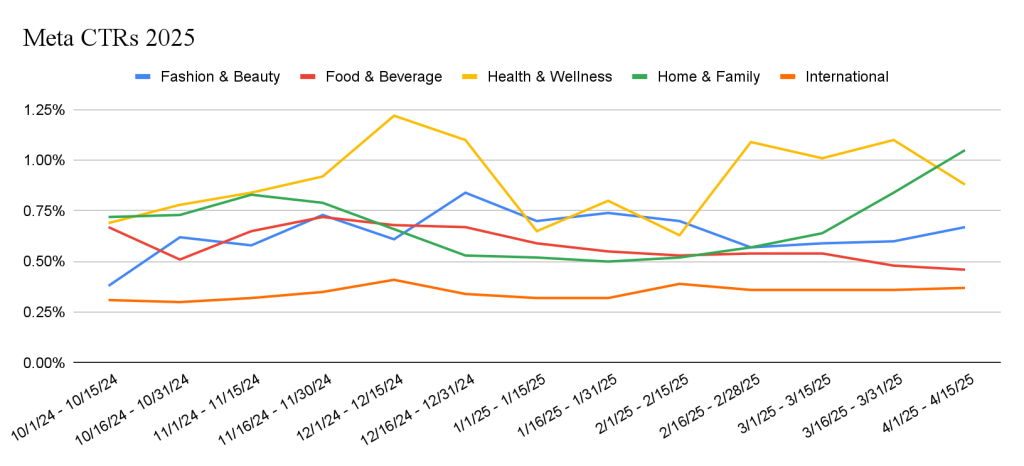

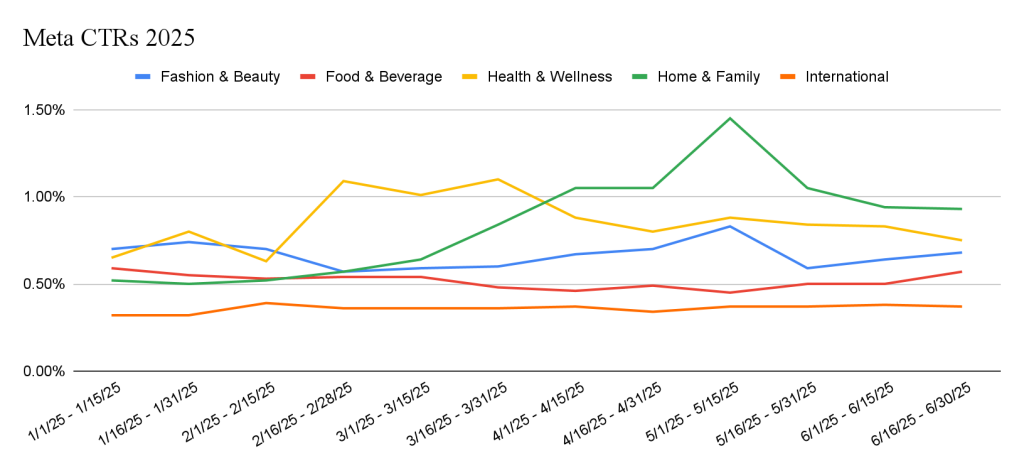

- Click-Through Rate (CTR): This is the percentage of people who clicked your ad after seeing it. A high CTR means your ad creative and copy are relevant to your target audience. A low CTR could mean you’re targeting the wrong people, or your ad just isn’t hitting the right notes.

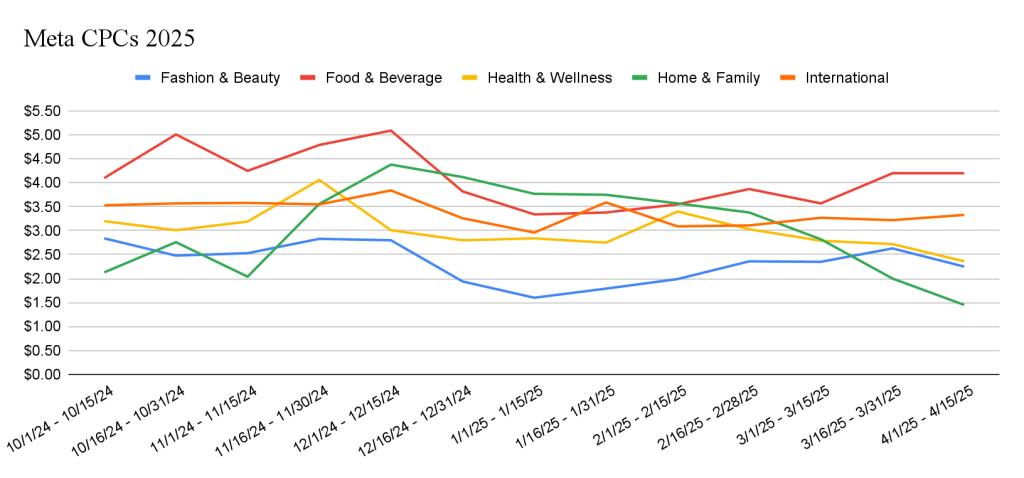

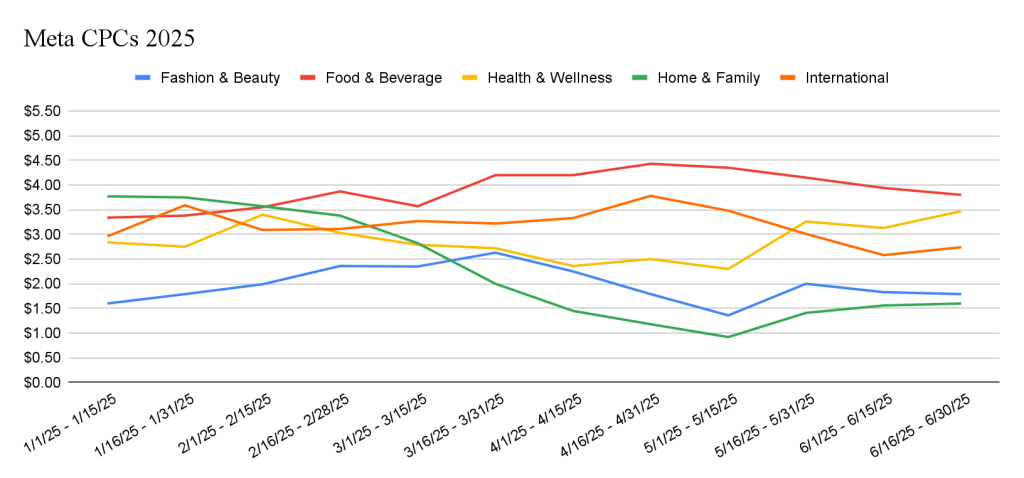

- Cost Per Click (CPC): This is how much you’re paying, on average, for a click on your ad. A low CPC indicates that Meta’s algorithm is targeting a large number of people who are interested in your ad, making it an efficient way to drive traffic.

- Cost Per Result (CPR): This is a key metric for many stages of the funnel. For the consideration phase, it tells you the average cost for a person to take a specific action, such as viewing a video, subscribing, or clicking a button.

The Conversion Funnel: The Metrics That Fuel Profit

This is the ultimate test of your campaign’s success. These metrics tell you if your ads are not just getting eyeballs and clicks, but if they’re actually making money for your business.

- Return on Ad Spend (ROAS): The king of all metrics. It tells you how much revenue you’re generating for every euro you spend. A 4x ROAS means you’re getting $4 back for every $1 you put in. For most businesses, this is the most important number in the entire dashboard.

- Cost Per Acquisition (CPA): This refers to the total cost of acquiring a new customer. You can use this to understand if your cost to acquire a customer is sustainable and profitable.

- Conversion Rate (CVR): This metric indicates the percentage of people who click your ad and actually complete the desired action (e.g., purchase, sign up). A high conversion rate means your offer and landing page are working well!

Pro Tip: Don’t chase a high ROAS in isolation. A high ROAS might come from a small, high-value audience. By monitoring your CPA as you scale, you can ensure that your growth remains profitable. The goal is to maximise profits, not just your ROAS.

Understanding the Metrics Hierarchy

Not all metrics are created equal. Think of them in two tiers:

- Primary Metrics: These are your ultimate scoreboard. For conversion campaigns, this is ROAS and CPA. For traffic campaigns, it’s CPR, CPC. These indicate whether your campaign is successful.

- Secondary Metrics: These are your diagnostic tools. CTR, CPC, Frequency, and CPM help you understand why your primary metrics are performing as they are. If your CPA is high, a low CTR clearly signals that your ad creative needs a tune-up.

The Troubleshooting Playbook

Metrics are just numbers until you put them into context. Let’s run a quick diagnostic to put these concepts into practice.

Imagine you’re running a campaign for a new line of children’s toys and are struggling to generate sales. Here’s how you’d use your metrics to diagnose the problem:

Low CTR + High CPCs:

You’re spending a lot to get clicks, but few people are clicking. This suggests that your ad creative or target audience is likely the issue. Your ad isn’t compelling enough, or you’re showing it to the wrong people.

How to Fix: Test new creative assets, or refine your audience targeting.

High CTR + Low CPC, but no conversions:

People are clicking on your ad, but they’re not buying. This indicates that your ad is effective, but your offer or landing page has an issue.

How to Fix: Re-evaluate your LP. Is the checkout process clunky? Is there something stopping people from continuing through?

High Frequency + Low ROAS:

People are seeing your ad, and your conversion rates are dropping. Your audience is exhausted.

How to Fix: Time to launch new ad creative to avoid ad fatigue and prevent your audience from tuning out. Or, send them to bed and let the audience rest and wake them again in a few weeks.

FAQ: Your Top Questions Answered

How do I know if my ad creative is working?

The first place to look is your CTR. If your CTR is low, it’s a strong indicator that your creative isn’t resonating with your audience. The ad might not be compelling enough to stop them from scrolling, or you might be targeting the wrong people. Conversely, a high CTR indicates that your ad is capturing attention and is a good candidate for further testing.

My campaign costs are rising. How can I diagnose the problem?

The first metric to check is your frequency. If your frequency score is high (above 3), it’s likely that your audience is becoming saturated and is experiencing ad fatigue. You’re paying more to show the same ad to the same people, who are no longer interested in it. You can also check your CPR. If it is steadily increasing, it means your audience is either getting more expensive or is less likely to convert.

My CPA is high, but my ROAS is good. How can my campaign be expensive but still profitable?

This is the perfect example of why you can’t rely on a single metric! It indicates that while the cost to acquire a customer is high, those customers are spending a lot of money with you, making the overall campaign profitable. In this case, your focus should be on finding more of those high-value customers, not just lowering your CPA.

How can I tell if my audience is getting too small?

Look at the relationship between your Reach and Impressions. As your campaign runs, if your impressions are climbing but your reach is flat or growing very slowly, it means you’re showing ads to the same group of people repeatedly. This is a clear sign that you’ve saturated your audience and need to either refresh your creative or expand your targeting to reach new people.

How a Performance Marketing Agency Can Help

Navigating the data, troubleshooting issues, and making real-time adjustments can be complex and lead to analysis paralysis. That’s where GeistM becomes your most valuable partner.

- The Data Detectives: We don’t just look at the surface-level metrics. Our team goes deep, utilizing advanced reporting and analysis to uncover the hidden insights that reveal the true story of your campaign.

- Proactive Optimizations: We continually monitor your campaign performance, making real-time adjustments to your budgets, bids, and targeting to ensure you achieve the best possible ROI.

- Holistic Funnel Analysis: We understand how a high-performing awareness campaign can lead to a more profitable conversion campaign. We connect the dots across the entire funnel, ensuring every part of your strategy works in harmony.

The key to mastering Meta Ads is to move beyond being overwhelmed by data and to start using it as a tool for making smart, strategic decisions. With these metrics in your arsenal, you’re no longer staring at a blinking dashboard in the dark. Or contact GeistM, and we can help!