Q4 2025 Digital Ad Rate Trends: Insights to Maximize Your Year-End Campaigns

As we move into Q4, marketers face a pivotal moment; this isn’t just “the season of sales,” it’s the season of?decisive impact. After the momentum built in Q3, consumers are gearing up for final?year decisions, including gift shopping, subscription renewals, year?end upgrades, and more. Digital ad landscapes are shifting accordingly — costs, click rates, and engagement behaviors are evolving fast.

Here is how Q4 is shaping up to be for us:

- Mid-October 2025

- End-October 2025

- Mid-November 2025

- End-November2025

- Mid-December 2025

- End -December 2025

Mid October 2025 (1st-15th)

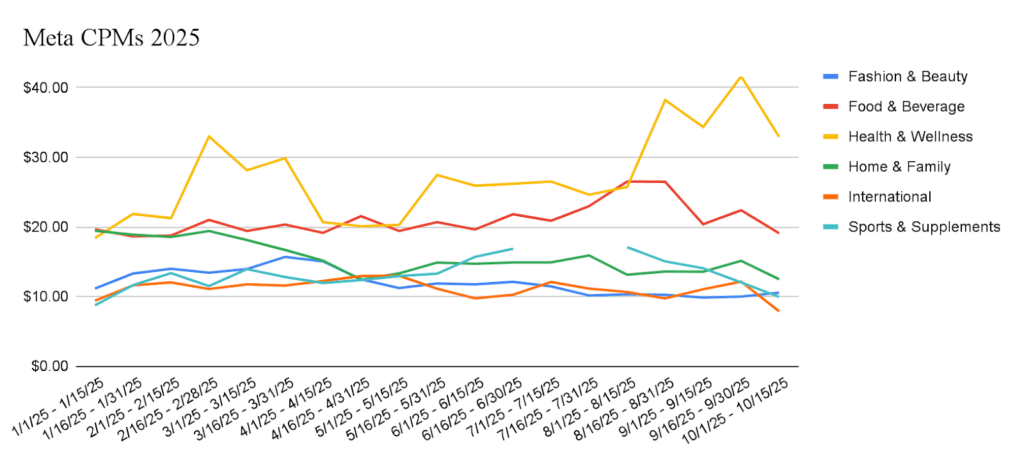

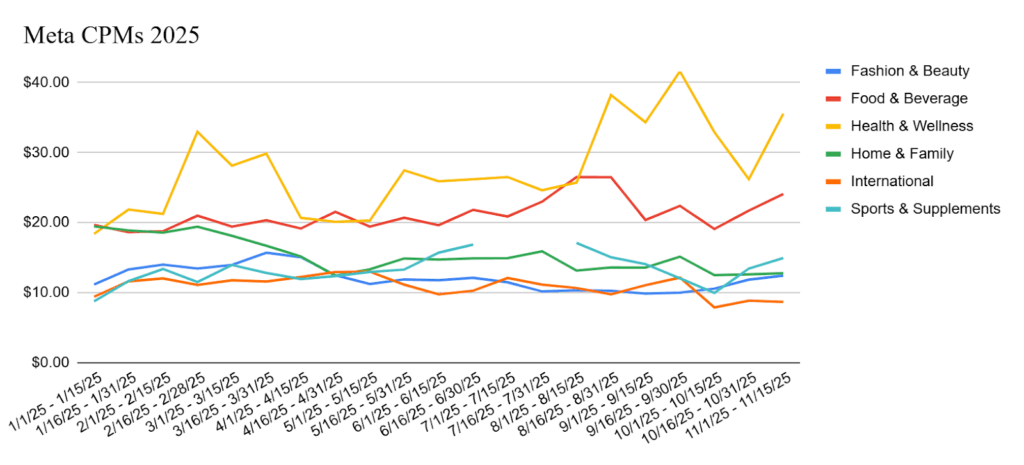

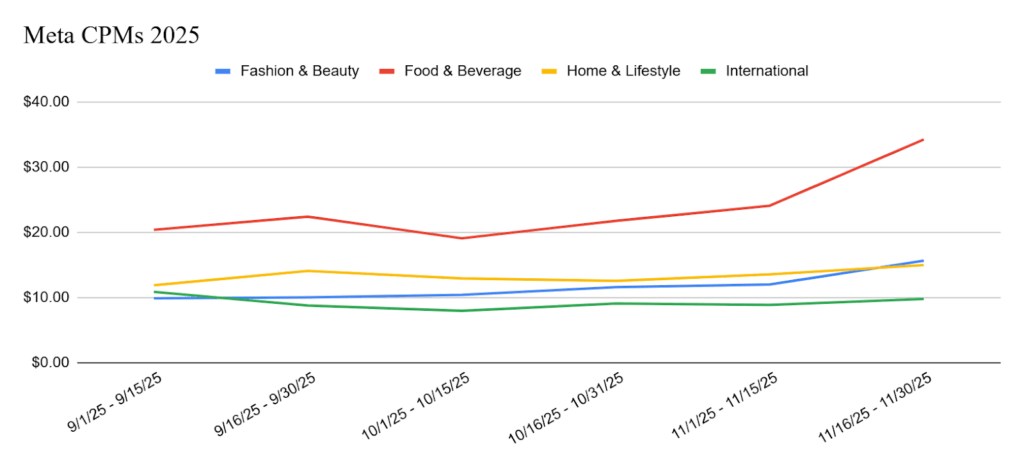

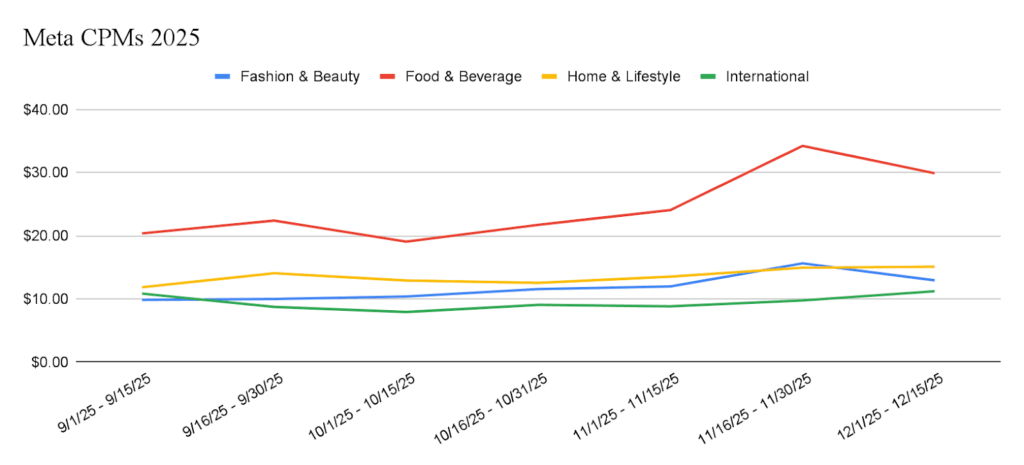

Meta CPM

Key Takeaways:

- CPMs decreased by 12% during the first half of October

- A significant decrease of 21% came from the Health & Wellness vertical

- The only vertical to remain stable during this period was Fashion & Beauty.

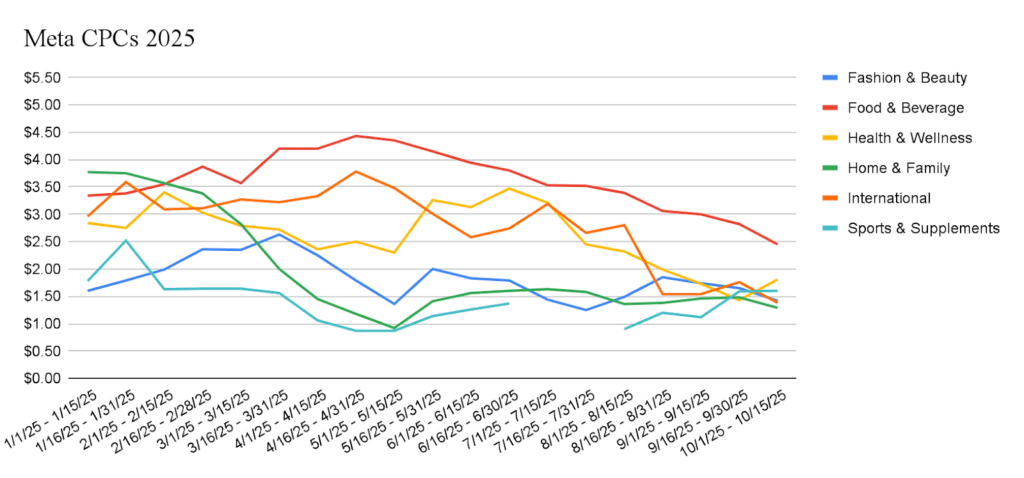

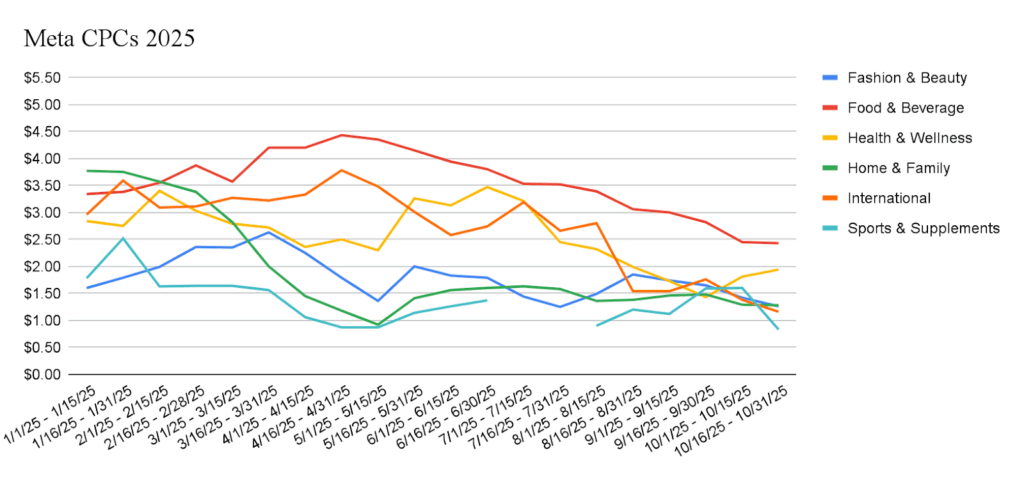

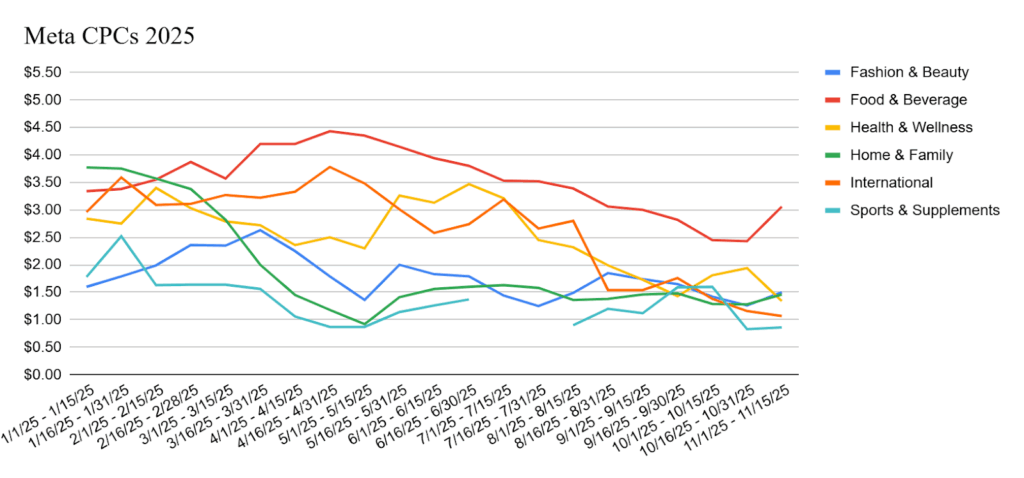

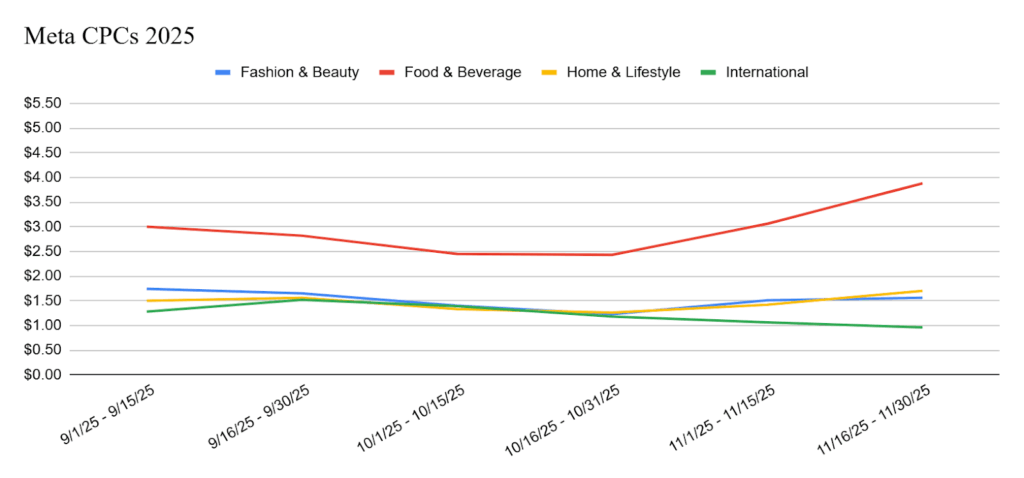

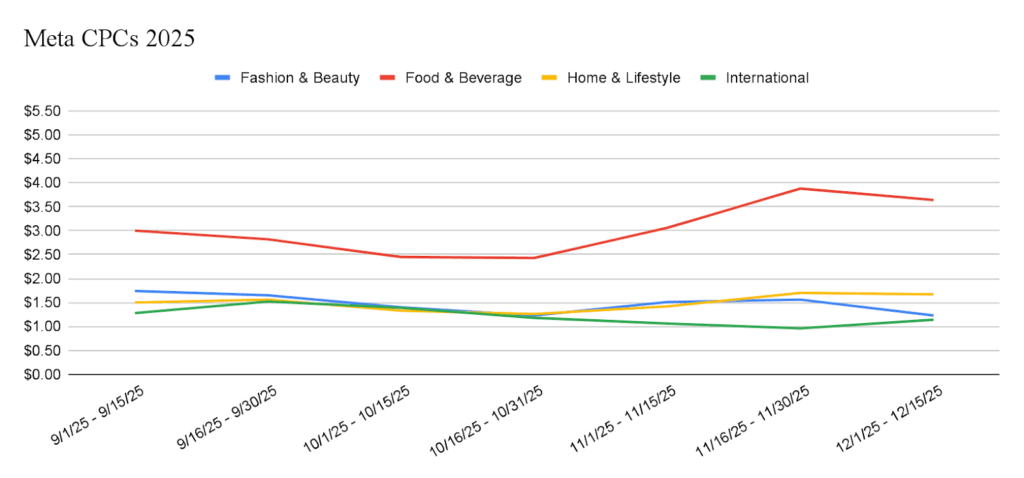

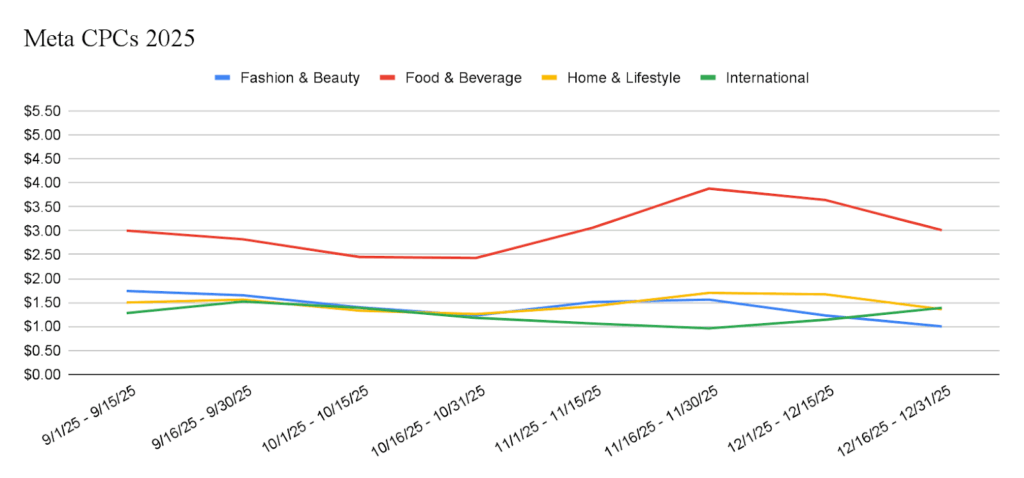

Meta CPCs

Key Takeaways:

- Analysts noticed a 15% decrease in CPCs during this period

- Fashion & Beauty saw the largest drop of 17% in CPCs

- A 27% increase was noted within the health & Wellness vertical.

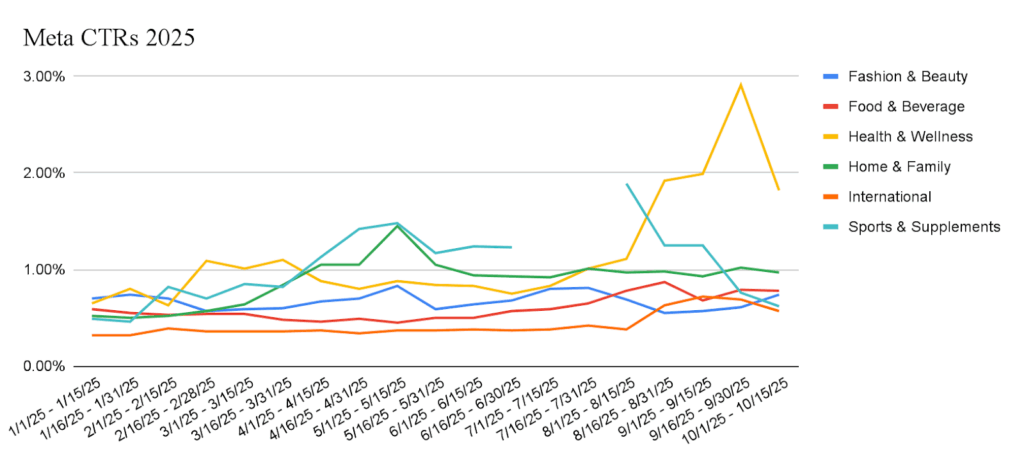

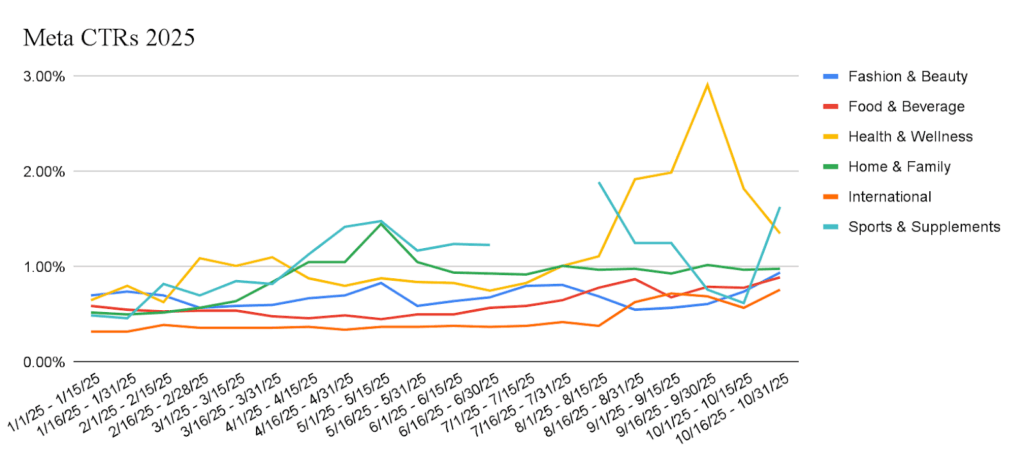

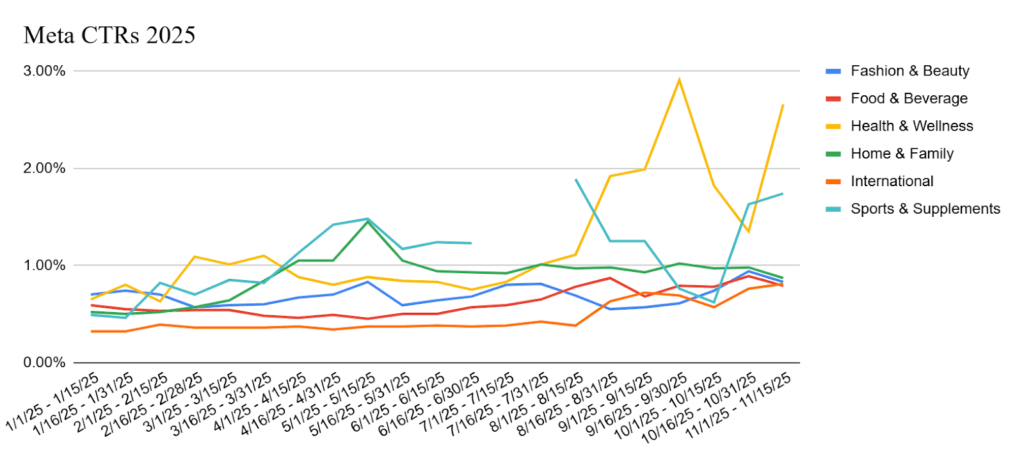

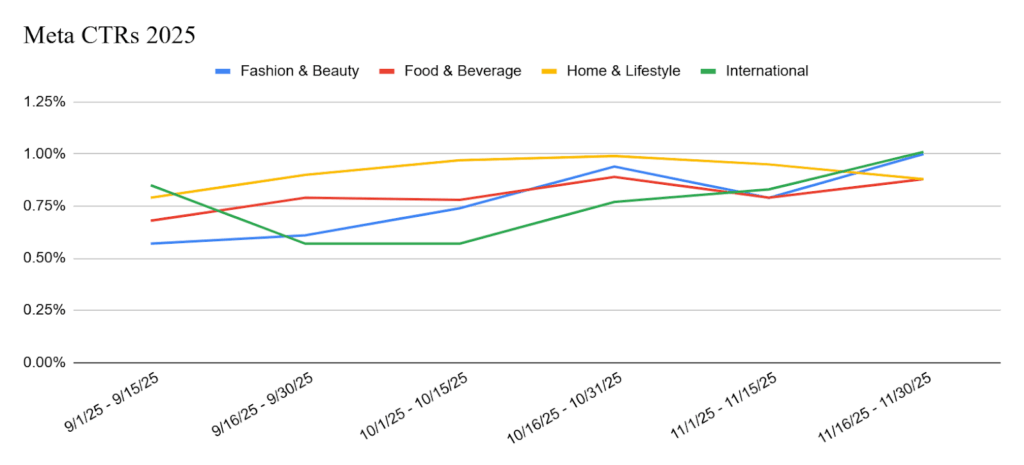

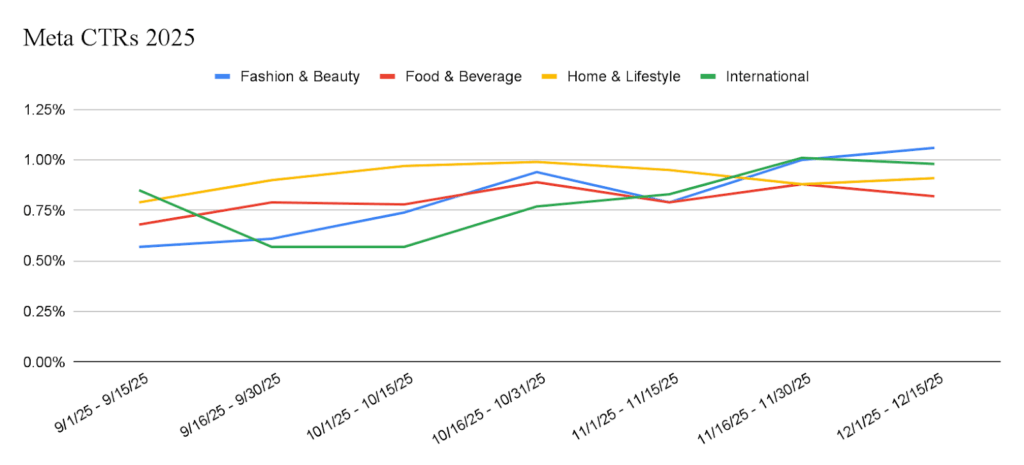

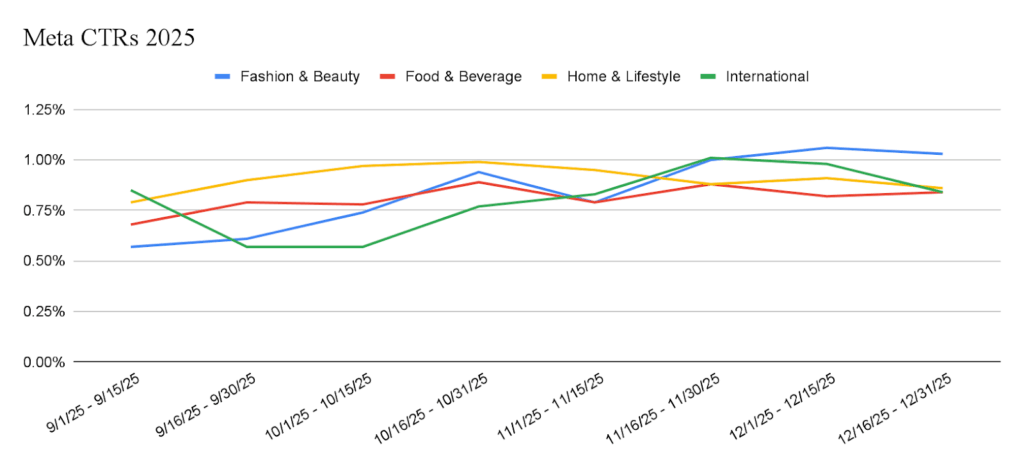

Meta CTRs

Key Takeaways:

- A slight 1% increase in CTRs at the beginning of October

- The biggest increase — 21% — was within the Fashion & Beauty vertical

- The Health & Wellness vertical saw a 37% drop in CTRs during this period. .

End-October 2025 (16th-31st)

Meta CPMs

Key Takeaways:

- Our analysts noticed a 7% increase in CPMs during this period

- A significant decrease of 20% was seen in the Health & Wellness vertical

- The Sports & Supplements vertical encountered the biggest increase in CPMs, at35%.

Meta CPCs

Key Takeaways:

- Our analysts noticed a 14% decrease in CPCs during this period

- The Sports & Supplements vertical saw the largest drop in CPCs at 48%

- The Health & Wellness vertical saw a 7% increase in CPCs.

Meta CTRs

Key Takeaways:

- CTRs increased by 19% during the second half of October

- A significant increase of 163% was seen within the Sports & Supplements vertical

- Whereas the Health & Wellness vertical experienced a drop of 26%..

Here’s what Senior Growth Analyst, Matthew Whitaker, has to say about these shifts.

“CPMs and CTRs rose while CPCs dropped in the second half of October. Black Friday/Cyber Monday are here! Your content/creative assets should be ready, but make sure to have any last-minute changes completed if needed!”

Mid November 2025 (1st-15th)

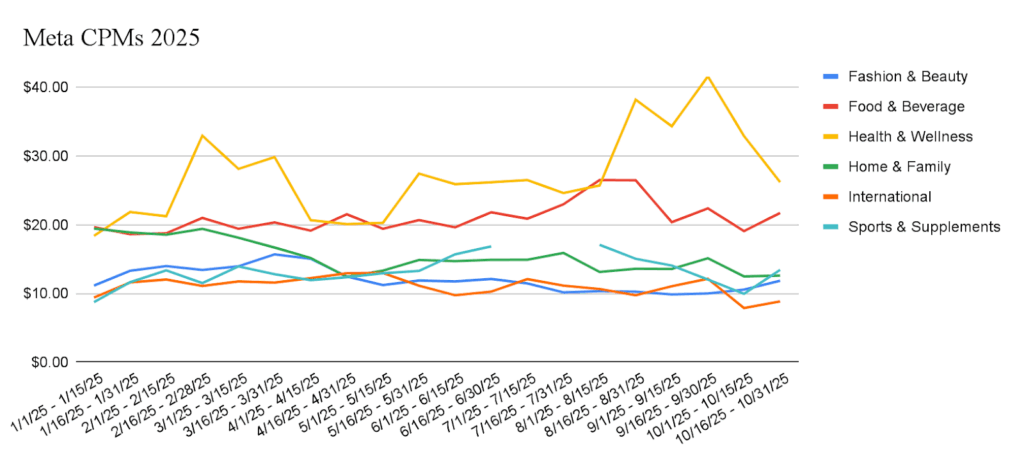

Meta CPMs

Key Takeaways:

- CPMs rose by 3% at the beginning of November

- The International vertical was the only one to experience a rate decrease, falling by 2%

- The Health & Wellness vertical encountered the biggest increase, rising 36%.

Meta CPCs

Key Takeaways:

- CPCs increased by 2% increase during this period

- The Health & Wellness vertical experienced a drop of 31%

- Whereas the Fashion & Beauty vertical had a 26% increase in CPCs.

Meta CTRs

Key Takeaways:

- According to our analysts, CTRs remained stable during the first half of November

- A surge of 97% came from the Health & Wellness vertical

- The Fashion & Beauty vertical experienced a minor decrease of 12%.

According to Senior Analyst Matthew Whitaker, here’s what we need to keep in mind for the rest of the month:

“Black Friday/Cyber Monday is here! Keep a close eye on daily spend/conversions and ensure there are eyes on accounts during the Thanksgiving break. Communicate with clients about additional holiday sales after Cyber Monday. Additionally, confirm any Christmas shipping cutoff dates.”

End November 2025 (16th – 30th)

Meta CPMs

Key Takeaways:

- CPMs increased by 11% in the second half of November

- The Food & Beverage vertical saw the largest increase, at 42%.

Meta CPCs

Key Takeaways:

- Our analysts noticed a 3% decrease in CPCs during this time period

- CPCs dropped 9% in the International vertical

- The Food & beverage vertical saw the largest increase in CPCs, at 27%.

Meta CTRs

Key Takeaways:

- CTRs increased by 14% across the board at the end of November

- The Fashion & Beauty vertical saw a significant 27% increase in CTRs

- Whereas the Home & Lifestyle vertical saw a 7% drop.

Mid-December 2025 (1st – 15th)

Meta CPMs

Key Takeaways:

- Our analysts noted an 11% increase in CPMs at the beginning of December

- A 15% increase in CPMs was seen in the International vertical

- The Fashion & Beauty vertical encountered a 17% drop in CPMs.

Meta CPCs

Key Takeaways:

- CPCs increased by10% increase during this period

- The International vertical experienced the largest rise at 19%

- The largest decrease, 21%, was in the Fashion & Beauty vertical.

Meta CTRs

Key Takeaways:

- There was a minor 1% increase in CTRs during this period

- The Fashion & Beauty vertical experienced a 6% jump in CTRs

- Whereas the Food & Beverage vertical had a 7% decrease in CTRs.

End December 2025 (16th – 31st)

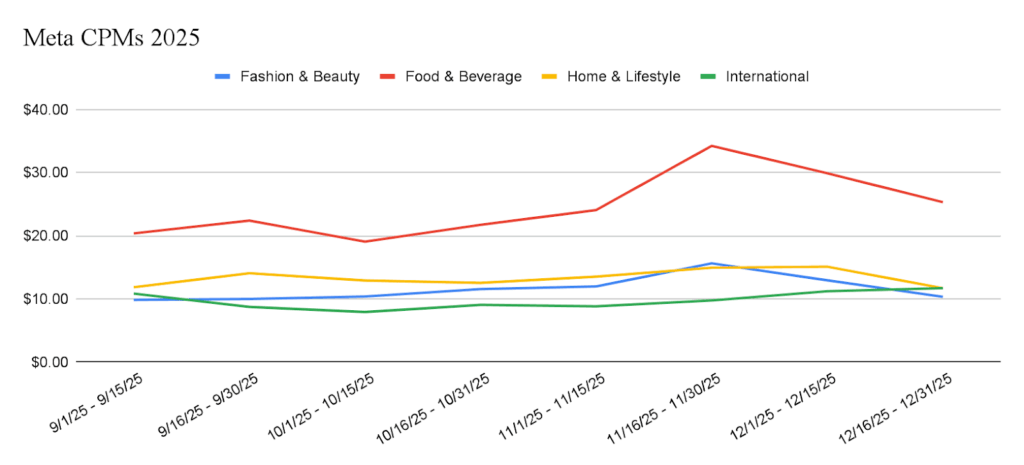

Meta CPMs

Key Takeaways:

- By the end of December, CPMs had decreased by 10%

- The largest increase (4%) came from the International vertical, while the Home & Lifestyle vertical saw the largest decrease (23%).

Meta CPCs

Key Takeaways:

- CPCs were stable during this time

- The International vertical saw the largest CPC increase at 22%

- CPCs in the Fashion & Beauty vertical decreased by 19%.

Meta CTRs

Key Takeaways:

- CTRs decreased by 9% during the second half of December

- The Food & Beverage vertical saw a 2% increase

- The International vertical recorded the largest decrease at 14%.

How GeistM can help

At GeistM, we’re not just observers of the ad platform landscape — we’re active navigators. As Q4 unfolds, our team is closely tracking evolving metrics across CPMs, CPCs, CTRs, and conversion flows, platform by platform, vertical by vertical.

With our real-time intelligence, we translate those trends into actionable campaign pivots: optimizing budget allocation, creative refresh timing, and targeting refinements so you stay ahead of seasonal shifts rather than playing catch-up.

If you’re looking to turn the late-year rush into strategic wins instead of reactive spending, we’re ready to help you make it happen. So contact us today!

You must be logged in to post a comment.