Meta Ads in Q2 2025 — What the Numbers Are Really Telling Us

Q1 always starts off strong, fueled by ‘new year, new me’ energy, big budgets, and a surge in consumer intent. Brands come out of the gate swinging, eager to capitalize on resolution-driven demand and high engagement. But as the calendar flips to Q2, things start to shift. We’re in that in-between season: the post-Q1 cooldown before summer’s Q3 ramp-up, then the holiday season’s strong finish in Q4.

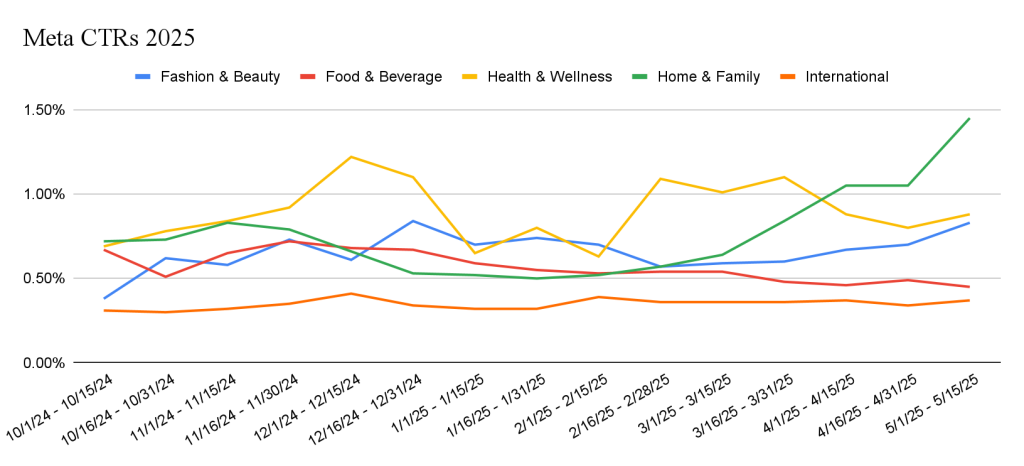

At GeistM we keep a close eye on spans shifting and audience behaviour evolving. We’ve seen movements in key ad metrics like CPM, CTR, and CPC. Whether you’re an advertiser calibrating your spend or a marketer fine-tuning your funnel, understanding these Q2 trends is crucial to staying ahead.

Let’s dive into the key Period-Over-Period (PoP) trends we’re seeing this quarter — and what to watch moving forward.

Mid-April 2025 (1st-15th)

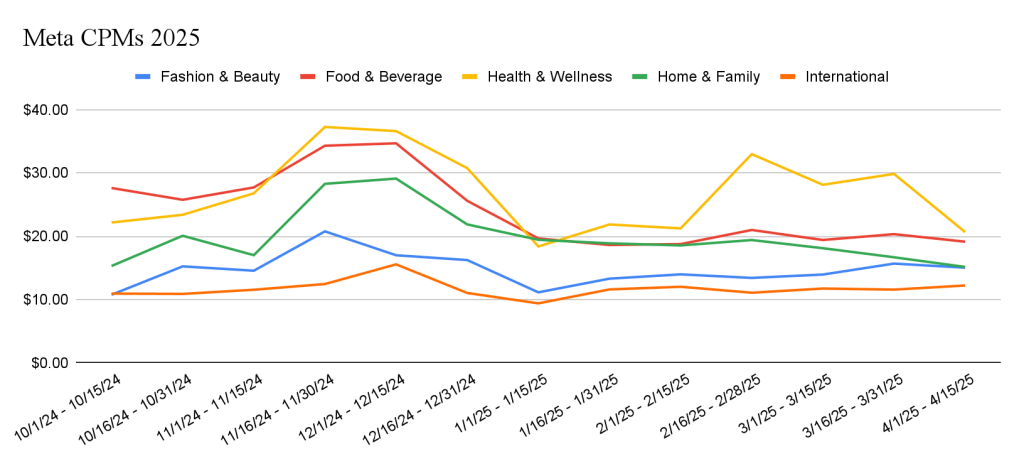

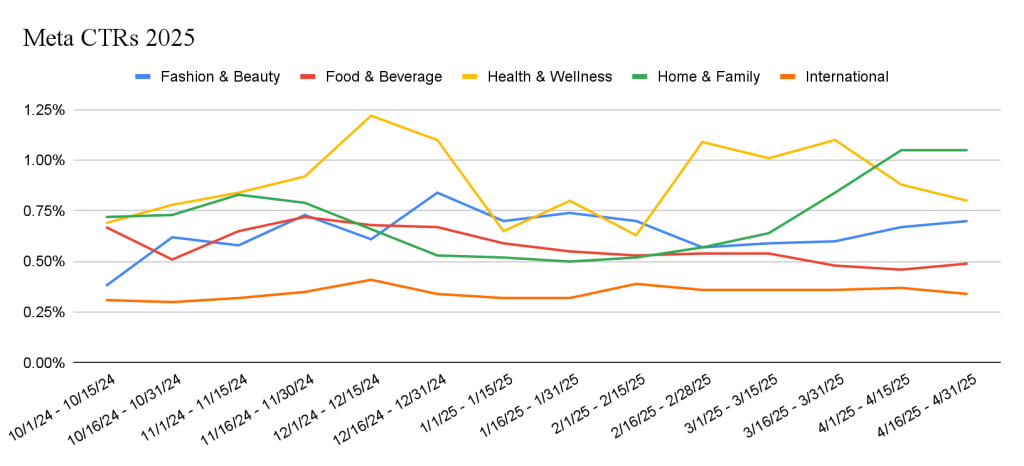

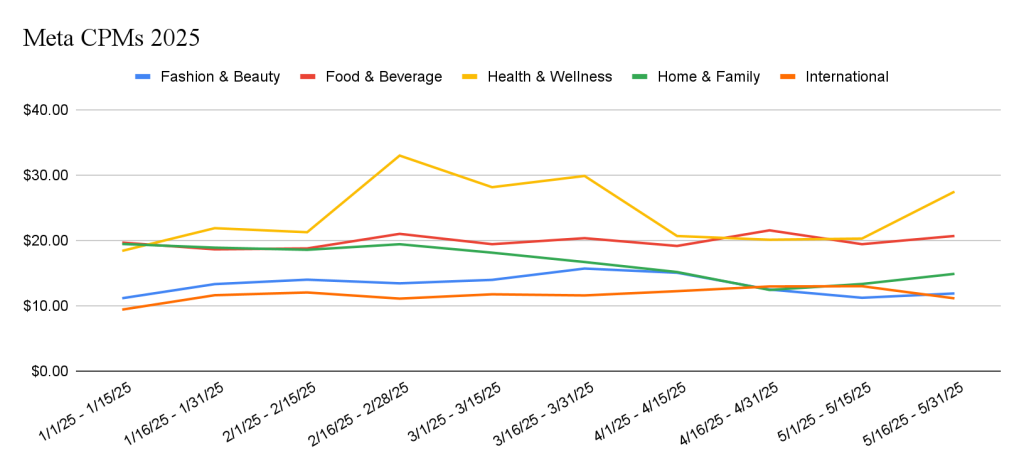

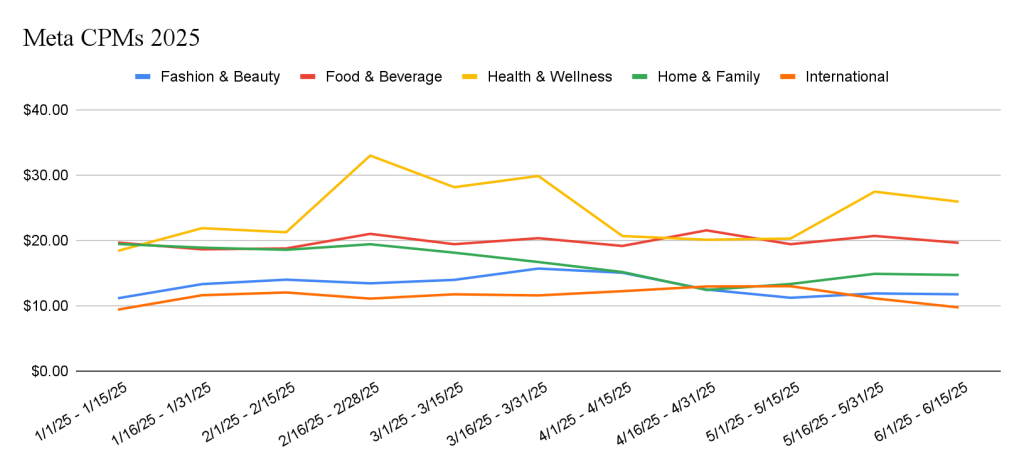

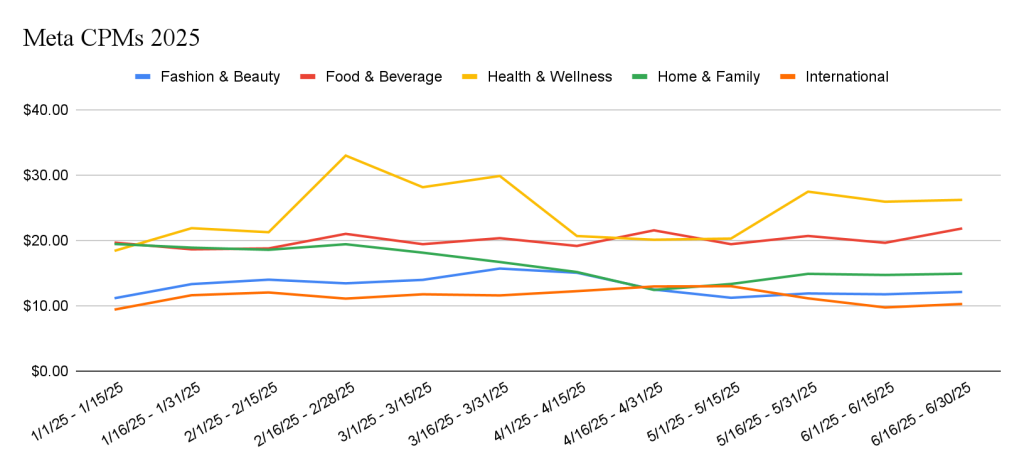

Meta CPMs

Key Takeaways:

- Our analysts noticed stable CPMs in the first half of April.

- The biggest decrease of -31% came from the Health & Wellness vertical.

- An increase of +6% was noted across International verticals (those operating outside of the US).

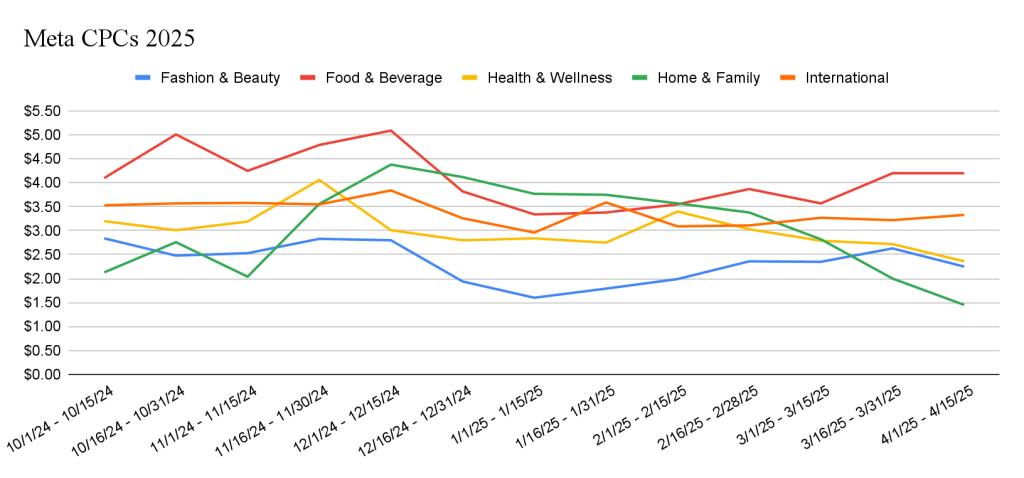

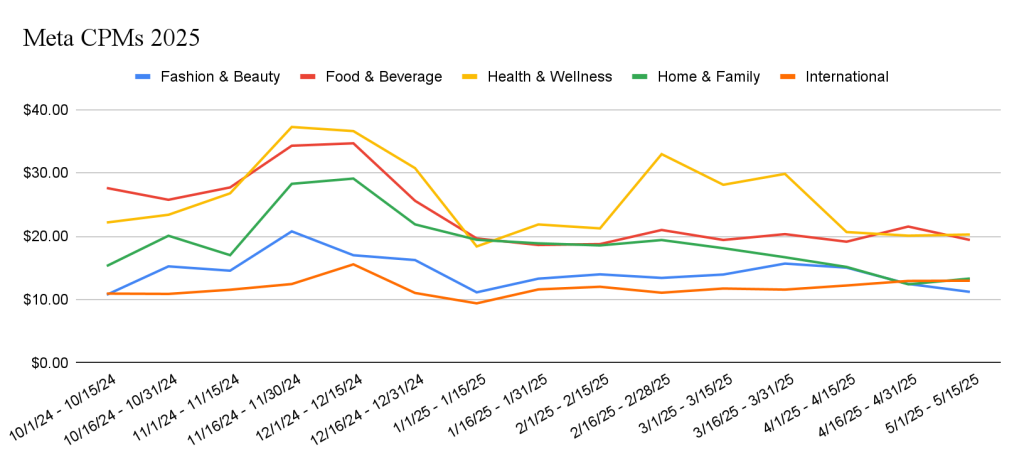

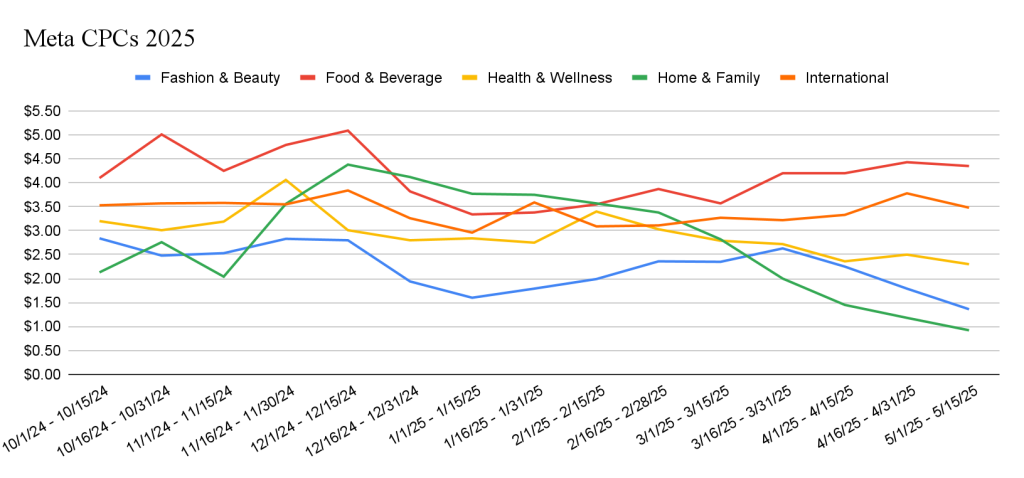

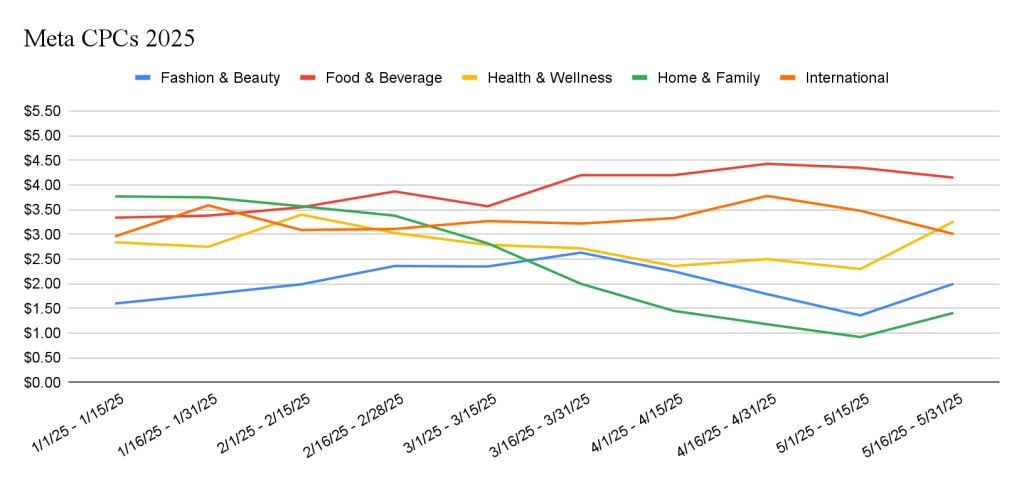

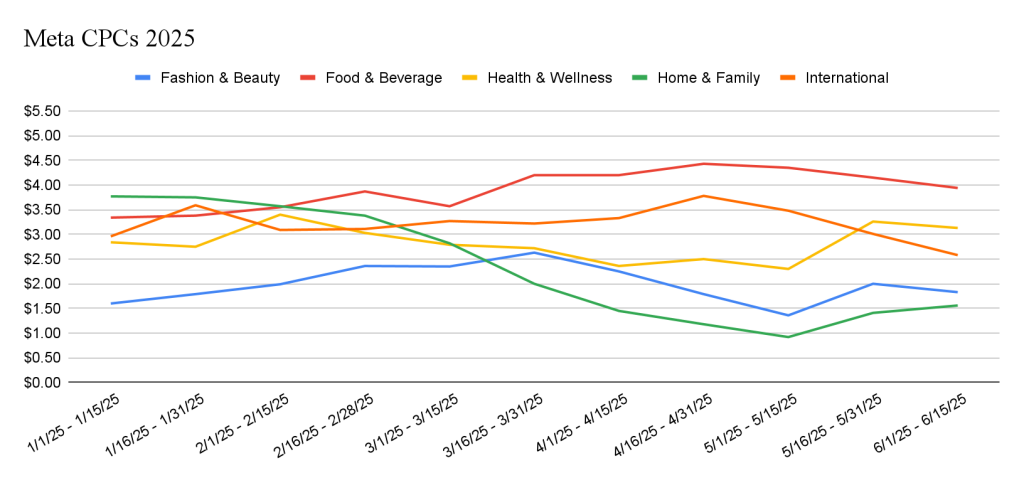

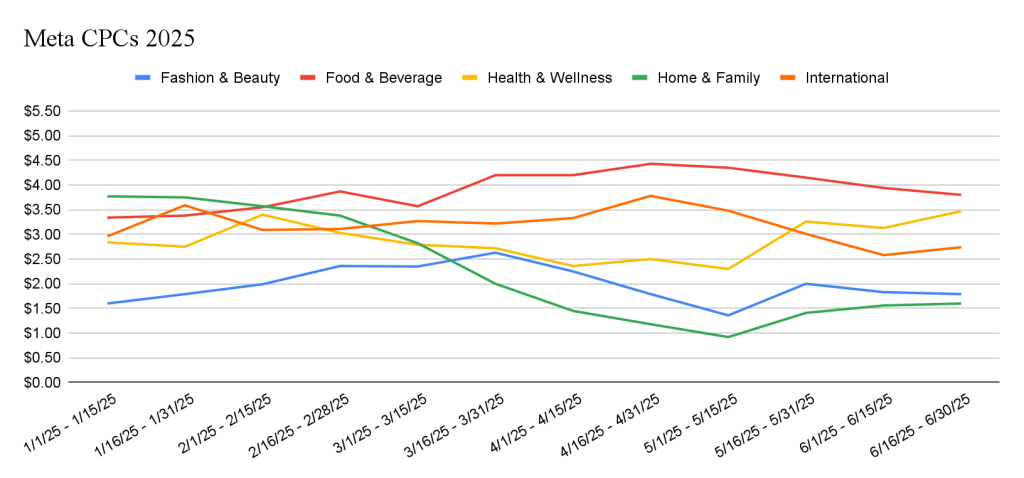

Meta CPCs

Key Takeaways:

- The team noticed a -14% decrease in CPCs during this time.

- A drop of -32% came from the Sports & Supplements vertical.

- The only jump of +3% came from the International vertical.

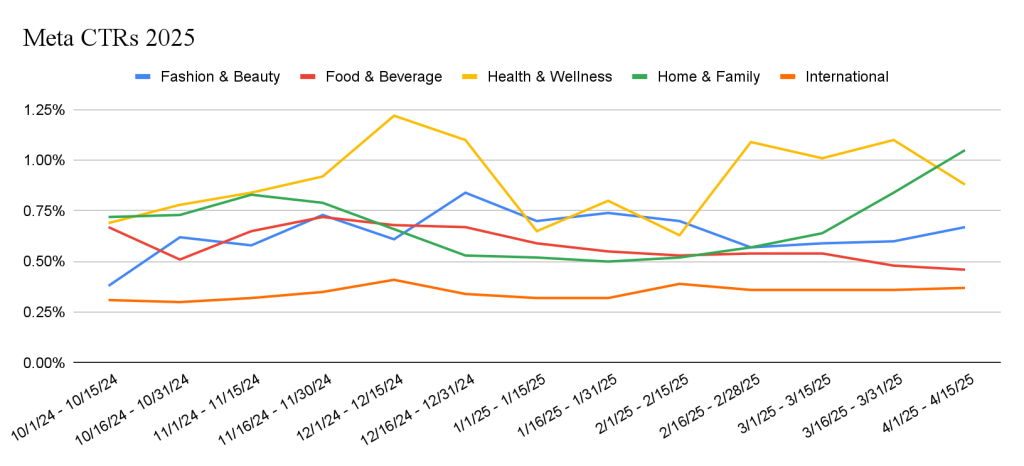

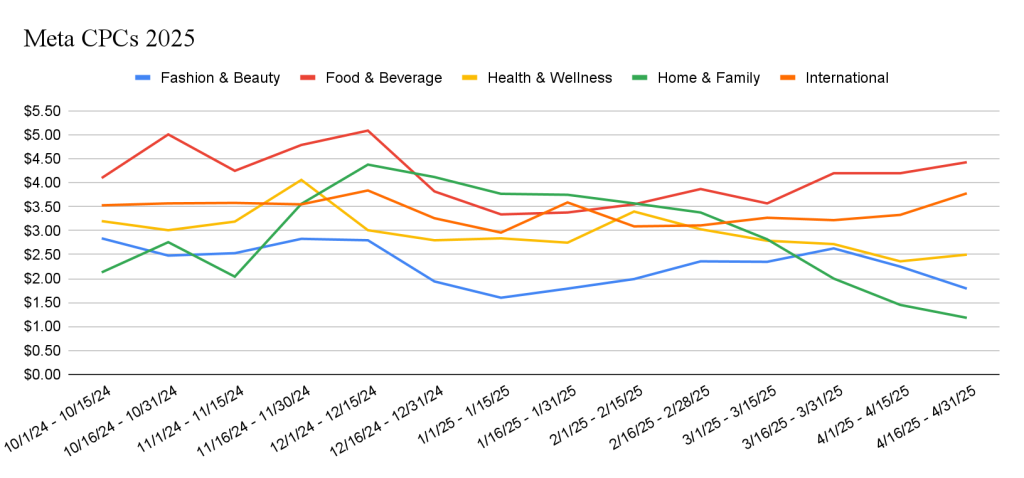

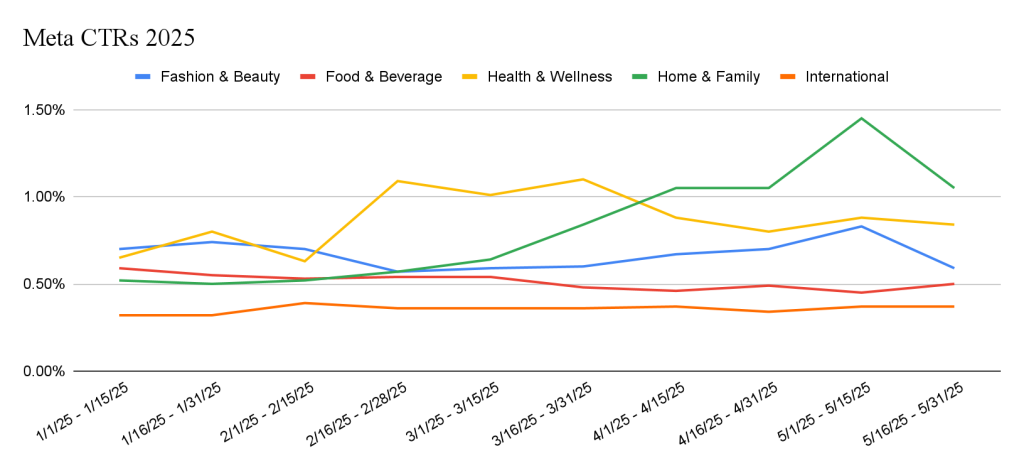

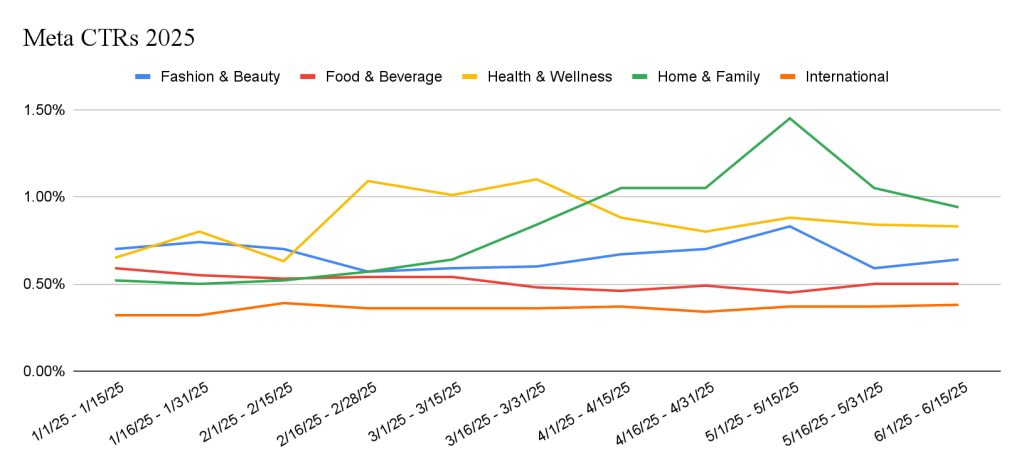

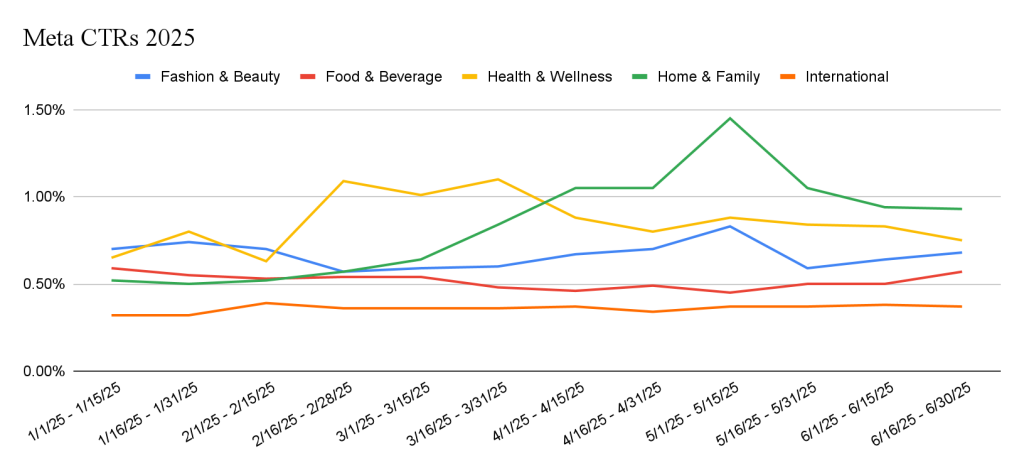

Meta CTRs

Key Takeaways:

- We noticed a +12% rise in CTRs in the first half of April.

- The largest increase, at +38%, came from the Sports & Supplements vertical.

- While the most notable decrease of -20% came from the Health & Wellness vertical.

When asked, this is what Senior Analyst, Matthew Whitaker, had to say:

“CPMs held steady this quarter, while CPCs saw a noticeable decrease and CTRs experienced a healthy lift. Additionally, it’s important to monitor any tariff-related impacts or shifts in client pricing, inventory, or supply chain dynamics, as these external factors can influence campaign performance and strategy in subtle but meaningful ways.”

End-April 2025 (16th-30th)

Meta CPMs

Key Takeaways:

- According to our analysis, CPMs remained stable during the second half of April.

- CPMs dropped by 18% in the Home & Family vertical.

- The Food & Beverage vertical saw the largest increase of 12%.

Meta CPCs

Key Takeaways:

- An overall 7% decrease in CPCs was noticed by our analysts.

- The Fashion & Beauty vertical saw the biggest drop of -20%.

- The largest jump of +14% came from the International vertical.

Meta CTRs

Key Takeaways:

- CTRs rose by +5% during this period.

- An increase of +26% was noticed by the Sports & Supplements vertical.

- The most notable decrease of -9% came from the Health & Wellness vertical.

According to our Senior Analyst, Matthew Whitaker, these are some moments to look out for,

“With the tariff impact, now is the time to check on our clients for any updates to their prices, inventory, or supply chain. And with Memorial Day around the corner, it’s also a good time to check if any clients are running promotions during that period.”

Mid-May 2025 (1st-15th)

Meta CPMs

Key Takeaways:

- Our analysts noticed a 4% decrease in CPMs during the first half of May.

- Fashion & Beauty vertical faced the largest decrease of 10%.

- The largest jump of 7% was seen by the Home & Family vertical.

Meta CPCs

Key Takeaways:

- CPCs decreased by 26% during this period.

- A large drop of 24% came from the Fashion & Beauty vertical.

- None of our verticals saw an increase in CPCs.

Meta CTRs

Key Takeaways:

- There was an 18% jump in CTRs at the beginning of May.

- A large jump of 38% came from the Home & Family vertical.

- An 8% decrease in CTRs came from the Food & Beverage vertical.

End May 2025 (16th-31st)

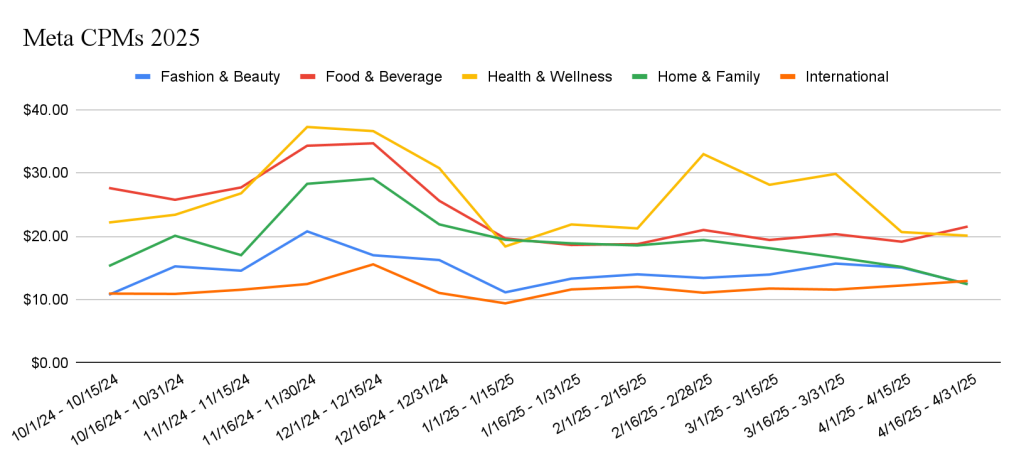

Meta CPMs

Key Takeaways:

- Our CPMs remained stable during this period.

- A 14% decrease came from the International vertical.

- A large increase of 35% was observed by the Health & Wellness vertical.

Meta CPCs

Key Takeaways:

- Towards the end of May, there was a 21% increase in CPCs.

- A large drop of 14% was noticed by the International vertical.

- While the Home & Family vertical saw a massive increase of 53%.

Meta CTRs

Key Takeaways:

- Our analysts noticed a 28% drop in CTRs.

- The only increase of 11% came from the Food & Beverage vertical.

- The biggest decrease of 29% came from the Fashion & Beauty vertical.

According to Senior Analyst, Matthew Whitaker, here are some moments to look out for in June:

“With Father’s Day and summer approaching, brands planning seasonal promotions or campaigns should align their messaging accordingly — and ensure budgets are allocated to support these key marketing moments.”

Mid-June 2015 (1st-15th)

Meta CPMs

Key Takeaways:

- The middle of June saw a 6% decrease in CPMs.

- The largest decrease, 13%, came from the International vertical.

- The Sports & Supplements vertical saw an incredible 18% jump.

Meta CPCs

Key Takeaways:

- There was a 6% decrease in CPCs during this period.

- The International vertical saw the largest drop of 14% in CPCs.

- An increase of 11% came from the Home & Family vertical.

Meta CTRs

Key Takeaways:

- Our CTRs remained stable during the first half of June.

- An 8% jump in CTRs was noticed by the Fashion & Beauty vertical.

- A decrease of 10% in CTRs came from the Home & Family vertical.

Here’s what Senior Analyst, Matthew Whitaker, had to say:

“If any brands are running promotions or aiming to leverage important marketing moments, it’s up to the account teams to budget accordingly. This includes events like the July 4th weekend for Independence Day as well as summer campaigns throughout Q3 that focus on seasonality-driven messaging and content.”

End-June 2025 (16th-30th)

Meta CPMs

Key Takeaways:

- A 7% increase in CPMs was observed during this period.

- None of the verticals noticed a decrease in CPMs.

- The largest rise, at 11%, came from the Food & Beverage vertical.

Meta CPCs

Key Takeaways:

- During the second half of June, there was a 3% increase in CPCs.

- A 4% drop in CPCs was observed in the Food & Beverage vertical.

- The Health & Wellness vertical saw an 11% increase in CPCs.

Meta CTRs

Key Takeaways:

- Our analysts noticed a 3% increase in CTRs during this period.

- The Food & Beverage vertical experienced a notable 14% increase.

- Whereas the Health & Wellness vertical reported a 10% decrease in CTRs.

According to Senior Analyst, Matthew Whitaker, these are some moments to look out for during the beginning of Q3:

“It’s officially Prime Week, with Prime Day extending across four days this year—from July 8th to July 11th, 2025. During this period, some brands may increase their spending not only on Amazon but across multiple platforms, so it’s worth scaling in the coming days. Additionally, the Back-To-School season is fast approaching in August, making this a key time to plan ahead.”

How GeistM Can Help

At GeistM, staying ahead of industry trends isn’t just what we do — it’s what we excel at. Through real-time optimizations and data-driven strategy, we ensure your campaigns stay efficient, effective, and always one step ahead of the curve.

As the year progresses and the digital landscape continues to evolve, now is the perfect time to partner with a team that knows how to navigate the complexities of platforms like Meta — and beyond. Let’s work together to turn shifting trends into strategic wins. Reach out today and see how GeistM can help you lead the charge.

You must be logged in to post a comment.